Credit dependence has already begun to haunt many people. The abundance of goods in stores, shopping centers, annual news in the field of electronics, the desire to have a good rest - make a person a regular consumer. But keeping up with the buyer's desires is often a small salary.

To buy a new phone or laptop, you need to dig up 3-4 months. But the employees of retail chains will advise you to make it much easier - immediately make a purchase by issuing a loan. And many people easily go for it. After all, obtaining a loan has now become much easier - no need to look for guarantors, collect an impressive package of documents. To make small purchases on credit, a passport is sometimes enough. Yes, and interest on the loan is small, and sometimes you can get interest-free installments.

Reasons for the development of credit dependence

The modern market makes consumers out of people and the following reasons can be distinguished for which a person may develop a credit dependence:

- easy to get a loan;

- the abundance of goods in stores;

- numerous advertisements;

- low interest on the loan or interest-free installments;

- Low wages.

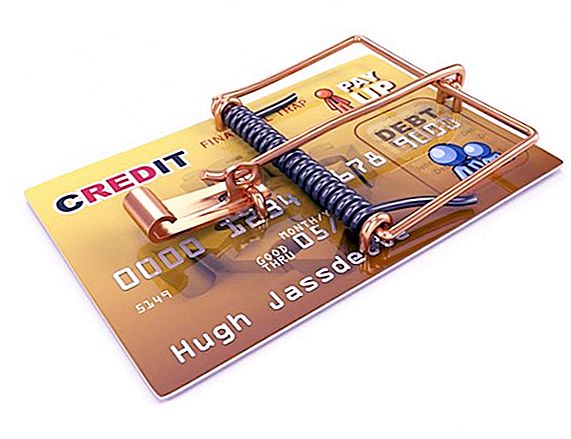

After making a couple of purchases on credit, a person may develop a credit dependence. It seems that everything is very good - I wanted to buy something and you have such an opportunity. But is credit addiction so safe?

Credit Addiction Hazard

Credit addicted customers usually do not stop at one purchase. Making loans for them is becoming a common practice. And it turns out that they are constantly debtors. Of course, the presence of debts affects the psychological state of a person.

Concerns arise - will a person be able to pay off the loan, what will happen if he does not pay the next payment on time, what penalties will be charged, can collectors come to him?

When the number of loans grows, the risk of default on them also increases significantly. And a person with credit dependence may be in a very unpleasant situation when you need to take a loan to pay for a previous loan.